Global Payment Systems, Local Challenges: How Optimus Fintech Solves Payment Reconciliation Complexities Across Borders

: Services / financial : San Francisco

Ad Details

-

Ad ID: 12310

-

Added: August 1, 2025

-

Condition: Brand New

-

Location: United States

-

State: CA

-

City: San Francisco

-

Views: 141

Description

As businesses expand across regions and embrace global payment systems, the complexity of managing transactions multiplies. With multiple payment service providers (PSPs), currencies, formats, and regional compliance standards, payment reconciliation becomes an operational burden — prone to delays, mismatches, and revenue leakage. This is where Optimus Fintech is redefining how global companies handle reconciliation.

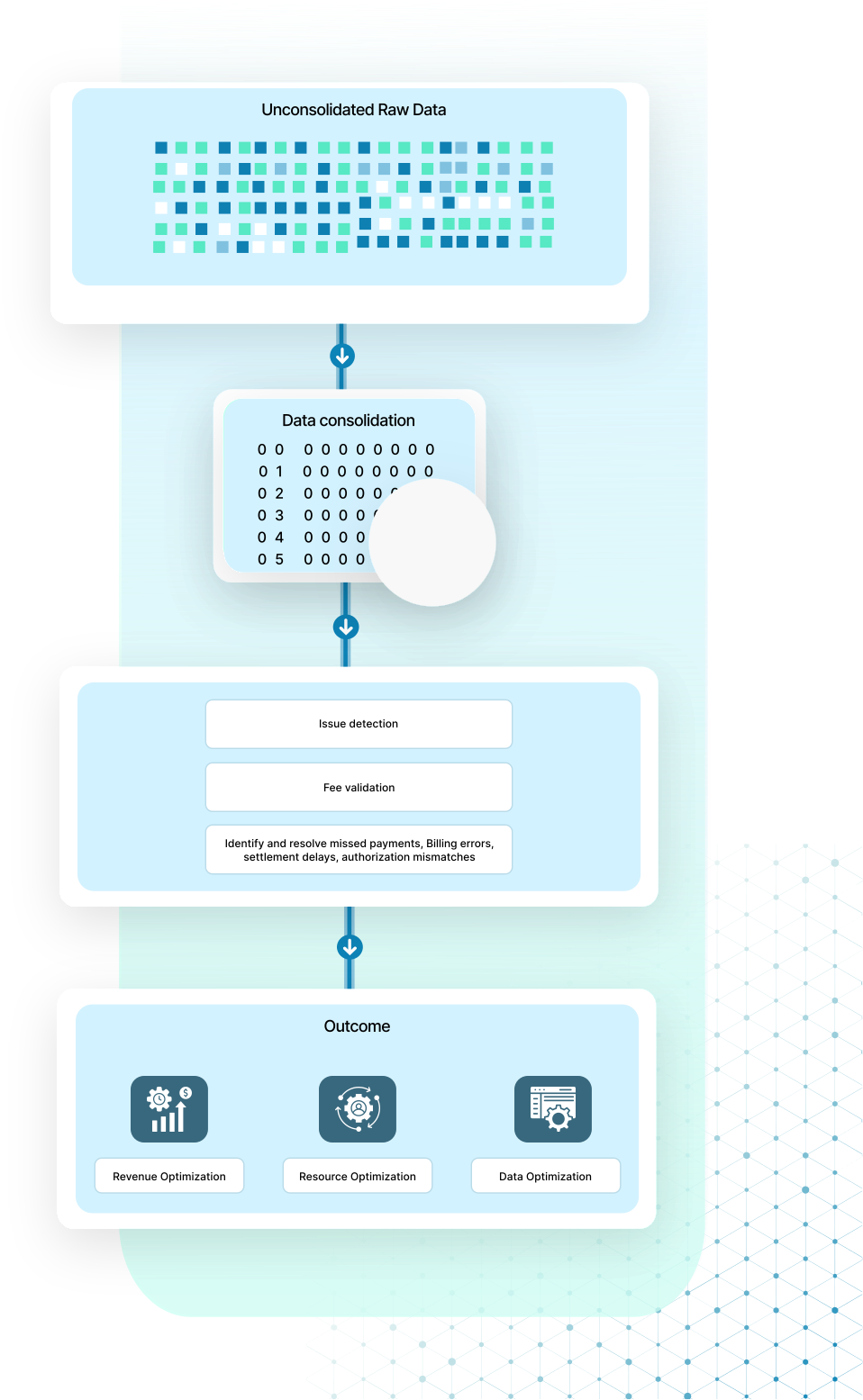

Most global companies today deal with a fragmented payment landscape. One region may use Razorpay, another Stripe, and a third may rely on direct bank integrations or local fintech platforms. Each PSP generates different data formats, settlement cycles, and fee structures. Manually reconciling these leads to inefficiencies, especially when scaling across countries. Optimus Fintech solves this with a centralized, automated, and intelligent payment reconciliation platform designed for global agility.

With Optimus, payment data from all PSPs — regardless of region or currency — is seamlessly aggregated into a unified dashboard. Its smart mapping engine normalizes fields, matches transactions in real time, and highlights discrepancies instantly. This dramatically reduces payment reconciliation time and minimizes human error, enabling finance teams to operate with confidence and speed.